Every year it seems as though the time between Thanksgiving and Christmas is full of EXCESS. Excess shopping, excess spending, excess eating, excess work, excess travelling... excess! excess! excess! (Say that three times fast!) My goal between now and Christmas is to do my damnedest to counteract that excess, by keeping in check the things that I can control.

While shopping for presents, it is very easy to fall prey to the endless sales, bargains, and advertisements and buy for yourself. My goal #1 is to not purchase anything for myself (besides food and necessities) between now and Christmas.

Since I will be spending a more than usual over the next month for Christmas presents for friends and family, I would like to counteract that by spending less than normal on my food budget. My Goal #2 is to spend only $20 a week on food (including dining out!) between now and Christmas.

My Goals #2 & #3 will need to balance with each other, making them my most difficult goals. My Goal #3 is to diet and eat healthy between now and Christmas. I think of it as an early start to my New Year's Resolutions.

So somehow I will need to eat cheap AND healthy. Ah... the eternal struggle.

Since I can't really control if I have excess work and excess travel to do (my family is scattered among numerous cities), my last goal relates to spending. My Goal #4 is a little more vague, but I would like to plan and budget for the Christmas presents I am buying, and still be completely satisfied that I have given personalized, worthwhile presents for my loved ones. I've already got some good ideas for this one.

Make some goals for yourself that help counteract the craziness that is the holiday season. Or feel free to join me in my goals! Although it may seem at first that making goals is just adding more things to do over the next month, when you already have a million things on your list, I believe that making a couple goals for yourself will help you to be more grounded, more in control, and less stressed during this holiday season.

Monday, November 26, 2007

Tuesday, November 20, 2007

Thanksgiving Soup Recipe- Pumpkin White Bean Soup

Here is a recipe for a very tasty soup, perfect for Thanksgiving. It is festive, different, delicious, filling, cheap AND easy to make. Did I mention that it is healthy as well? If you're looking to stretch your budget and try something new for Thanksgiving this year, give this recipe a try!

PUMPKIN WHITE BEAN SOUP:

Ingredients:

1 sprays olive oil cooking spray, or enough to coat pot

1 medium onion(s), coarsely chopped

15 oz canned pumpkin

3 1/2 cup fat-free chicken broth

15 1/2 oz canned white beans, rinsed and drained

1/4 tsp ground oregano

1/8 tsp table salt, or to taste

1/8 tsp black pepper, or to taste

6 Tbsp grated Parmesan cheese

Directions:

Coat a large soup pot with cooking spray and set over medium-low heat. Add onion, cover and cook until tender, stirring occasionally, about 6 minutes.

Stir in pumpkin, broth, beans and oregano; simmer 8 minutes.

In a blender, process soup in batches until smooth. (Note: Make sure not to overfill blender in order to avoid splattering.) Return soup to pot and reheat; season with salt and pepper.

To serve, ladle soup into bowls and top each with 1 tablespoon of grated cheese. Yields about 1 cup per serving.

This recipe was highlighted as one of the seasonal recipes on weightwatchers.com.

PUMPKIN WHITE BEAN SOUP:

Ingredients:

1 sprays olive oil cooking spray, or enough to coat pot

1 medium onion(s), coarsely chopped

15 oz canned pumpkin

3 1/2 cup fat-free chicken broth

15 1/2 oz canned white beans, rinsed and drained

1/4 tsp ground oregano

1/8 tsp table salt, or to taste

1/8 tsp black pepper, or to taste

6 Tbsp grated Parmesan cheese

Directions:

Coat a large soup pot with cooking spray and set over medium-low heat. Add onion, cover and cook until tender, stirring occasionally, about 6 minutes.

Stir in pumpkin, broth, beans and oregano; simmer 8 minutes.

In a blender, process soup in batches until smooth. (Note: Make sure not to overfill blender in order to avoid splattering.) Return soup to pot and reheat; season with salt and pepper.

To serve, ladle soup into bowls and top each with 1 tablespoon of grated cheese. Yields about 1 cup per serving.

This recipe was highlighted as one of the seasonal recipes on weightwatchers.com.

Wednesday, November 14, 2007

Budget: How Bare Boned Can it Get?

Just for fun I decided to find out what my budget could look out if I cut out EVERYTHING possible. No cable, no dining out, $100 for entertainment for the month, etc. Bare minimum only!

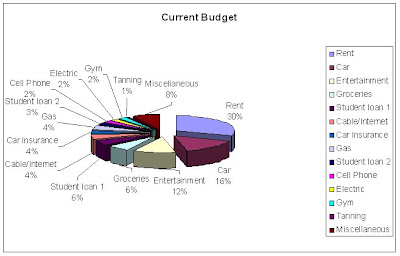

Just for fun I decided to find out what my budget could look out if I cut out EVERYTHING possible. No cable, no dining out, $100 for entertainment for the month, etc. Bare minimum only!For comparison, here is my current budget:

*Although I pointed this out in my first budgeting post, I want to note again that this budget is my take home pay, aka after my 401K contribution.

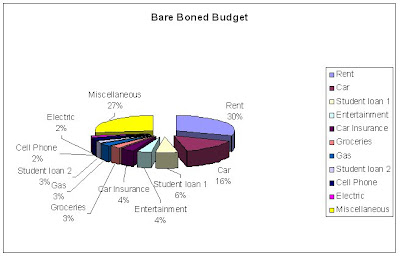

Here is what I could make it, if I super SUPER sacrificed:

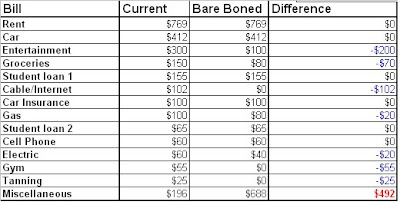

This makes a whopping 19% difference in my spare funds! Impressive! I thought I was on a tight budget already. This table shows the amount difference in each category, in dollars rather than percent.

Analysis:

Rent, Car, Loans, Cell Phone, and Insurance are fixed. I have decreased the amount available for Entertainment, Groceries, Gas, and Electric. And I have completely removed cable, my gym membership, and tanning.

I would have to make some drastic changes to live on this budget, but if push came to shove, it would be do-able.

I currently give myself a very lenient Entertainment budget. I enjoy concerts, going out to bars, and travelling. If I needed to, I could find inexpensive alternatives to keep myself entertained. I could go to the bars, but not drink (as my mother is always encouraging me to do!), I could take advantage of the free/cheap local events in my area, and I could put off any major travelling for a year or so.

I am currently pretty frugal with my Groceries budget. I treat it as a game to see how little I can spend on groceries, but still eat well. I rarely dine out, or order in, and really enjoy finding new, inexpensive recipes to cook at home. My latest obsession is making new soups! Yet, I am completely sure that if I gave myself a $20 a week budget for food I could do it. Off the top of my head, I could decrease the amount of meat I consume by having one or two “meatless” days each week, eat oatmeal for breakfast (cheap AND healthy), stop drinking soda, and do some of my grocery shopping at ethnic markets. I’ve also been having some crazy thoughts about using ramen noodles in some sassy recipes… there will probably be an entire post on that.

Saving $20 on both gas (as in automobile gas) and my electric bill is something I’d have to experiment with to see if it was possible. Currently, I pay little attention to either. Limiting my travel (per my entertainment cuts) would naturally save gas. I could also plan my errands to be more efficient, not drive home for lunch hours as much, and use public transportation when possible. I think I could make a $20 difference in my gas bill with just a small effort. And for my electric bill, I could be more cautious about leaving lights and fans on, and unplug chargers when not in use. Lastly, not using my air conditioner as frequently in the summer months would make a large difference.

And now the three bills I could cut out completely; my cable package, my gym membership, and my tanning membership. Tear! It would be sad to see these things go, they are the luxuries that I most enjoy.

Many bloggers have talked about doing without their cable package, and most of them find themselves to be happier, more productive people! Could I possibly be one of these people? Or would I become a social outcast, not knowing the latest plot line of Desperate Housewives? If I just couldn’t cut out TV cold turkey, there are many shows that you can catch for free on the Internet. Abc.com has a good number of their shows online including Desperate Housewives, Brothers & Sisters, Grey’s Anatomy, Ugly Betty, and many more. USA Network also has shows online, Monk for one. I currently get together with one of my old college roommates on Thursdays for some catch up time and to watch Ugly Betty and Grey’s Anatomy. If she didn’t mind we could always watch it at her place, and take turns bringing the cuisine! In other words, I think I would survive… and maybe even prosper.

My gym membership is a luxury that I decided was worth the money, because I was worried about staying in shape post college…post walking a mile to class, post walking everywhere I needed to go, post living within walking distance to an amazing campus gym, post having the schedule that gave me time to visit that gym regularly. I have enough trouble keeping my will power and motivation up, and I wanted a workout facility available to me 24 hours a day, so that will power and motivation would be my only worries. Yet, I could stay in shape without a gym, if I put my mind to it. I could start the “Couch to 5K” program, which I have always wanted to complete. Walking/Running is all this requires, and this can be done outdoors. My apartment has a small, barely adequate gym in the basement. If the weather is crappy I could use their treadmill. My Dad and Step mom lives less than a mile from where I work, and they recently renovated part of their basement into a workout room. I could go there during lunches, before work, or after work, and get a full work out. I own several workout DVDs that I could use in my very own apartment. After listing all of these options, it actually seems to me that I have plenty of resources available that make the gym membership negligible.

Conclusion:

Creating a “Bare Boned Budget” is a great exercise to motivate yourself to “trim the fat” off of your current budget.

1. First, get out your current budget (or make one if you haven’t done that yet!). Next, figure out which things you could remove completely, thinking as if you didn’t really have to do it.

2. Then of the remaining, figure out how much you could cut back on each one, again, as if you didn’t really have to do it.

3. Create a pie chart of each budget and look at them side by side. Make a table that calculates the dollar amount difference that you would save in each category.

4. Then write a sentence or two about each change. Would you miss it? What would you have to do to make the goals? What are your alternatives? What would your plan be for the excess money?

5. Take action!

I also noticed that doing one thing often affected two different areas of the budget. For example, travelling less helped me cut back my entertainment budget AND my gas budget. Working out on the weekends would be a cheap alternative to my usually expensive entertainment options, AND help keep me in shape without my gym membership. Saving gas by not going home for lunch would give me time to visit my Dad and Step mom's house for a lunch hour workout, an alternative to my gym membership.

I know that writing this made me think “WOW, I could actually do this!” Give it a try and see if you have a similar experience.

Subscribe to:

Posts (Atom)